How to Easily Calculate Your Monthly Mortgage Payment

When it comes to mortgages, it’s all in the math!

The better you understand the mortgage math that matters when determining your loan options, the better off you’ll be when it’s time to sign those closing papers with confidence.

In this guide, you’ll learn about the numbers that make up a monthly mortgage payment, plus any hidden costs you should be aware of to be a savvy borrower.

What’s a mortgage?

A mortgage is a loan that’s specifically used to purchase a house. Since you may not have enough cash as a first-time homebuyer to buy a house outright, you’ll need a mortgage from a lender to help pay the balance. Then once you have a mortgage secured, you make payments with interest – typically once each month – to that lender.

When considering what your monthly mortgage may cost, remember that you’ll be paying back more than just the amount of the loan.

Before you understand the mortgage math, it’s important to know that a mortgage has two parts: the principal (your loan amount) and the interest (what the lender charges you for borrowing their money). And since interest is calculated on the amount of principal you owe, the longer you take to pay back your mortgage, the more interest you’ll end up paying.

That’s why accelerated payments that allow you to pay off your mortgage faster can work in your favor and save you thousands of dollars over the life of your loan.

What do I need to calculate a monthly mortgage payment?

Here are a few must-know terms to help you feel empowered to talk mortgage math:

- Purchase Price is the total amount you give to the seller or builder to buy the home.

- Down Payment is the up-front money you pay to the lender upon purchasing a home (typically either 3%, 5%, 10%, or 20% of the purchase price)

- Loan Amount is different from the purchase price, as it’s the actual amount you borrow from the lender. It can be calculated by subtracting the down payment from the purchase price.

- Term is the length of your loan, so the amount of time you’ll pay off your mortgage if you make all your normal monthly payments. Fixed mortgage terms are typically 10, 15, 20, or 30 years.

- Mortgage Type is the actual mortgage option you select for your loan. One option is a fixed mortgage that keeps your interest rate the same for the duration of the loan. An adjustable-rate mortgage (ARM) is when the interest rate is locked in for the first 5 years or 10 years (respectively) and then is updated annually each year after that. However, the most common type of mortgage is fixed.

- Mortgage Principal is the outstanding balance of your mortgage. This can be calculated by subtracting how much of the loan you’ve paid back from the amount borrowed from the lender.

- Interest Rate is what your lender charges you for borrowing their money to purchase a home. It’s typically a percentage and most often calculated monthly as part of the monthly mortgage payment.

You may also be interested in knowing your complete mortgage documentation checklist

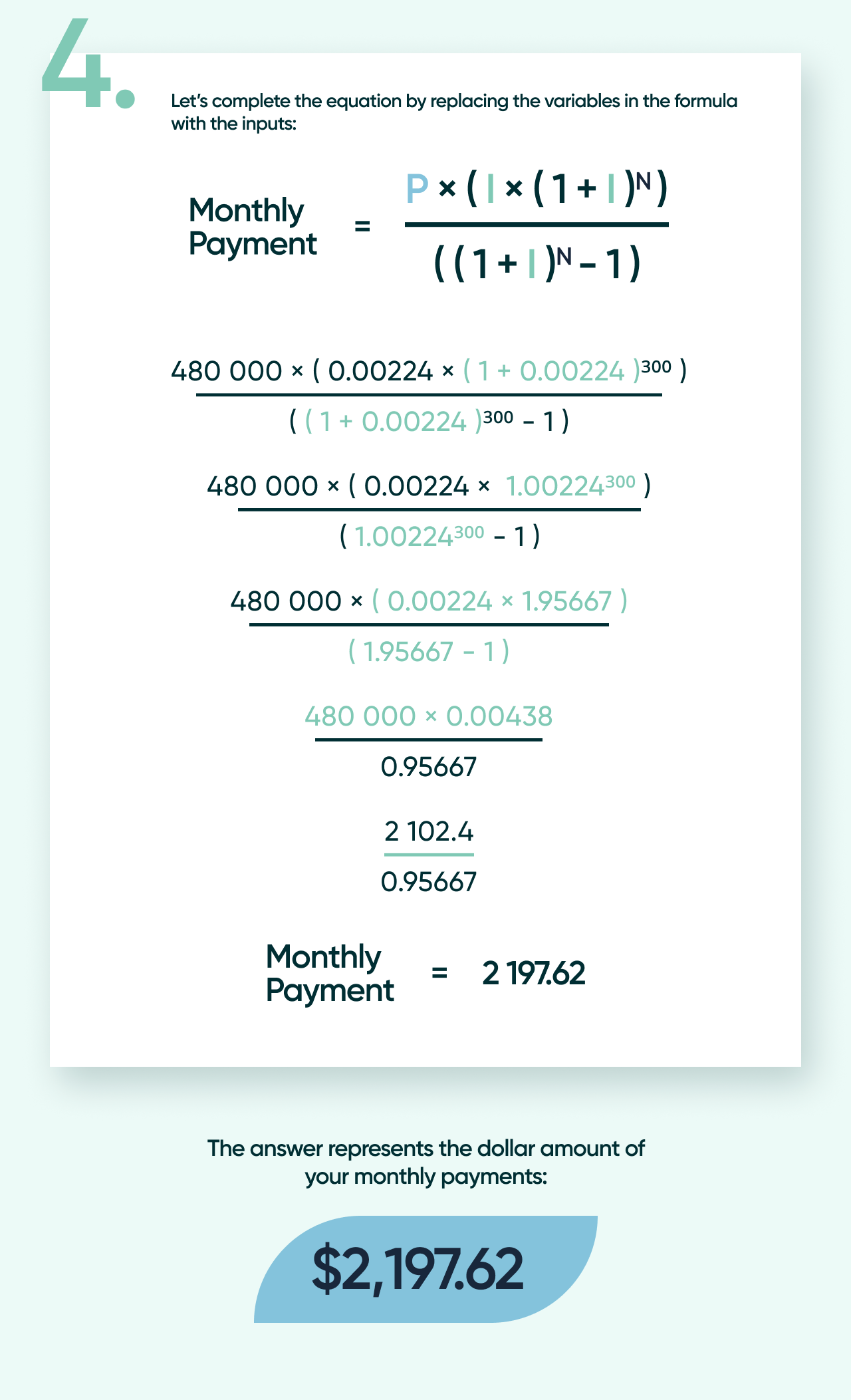

Mortgage Math Formula

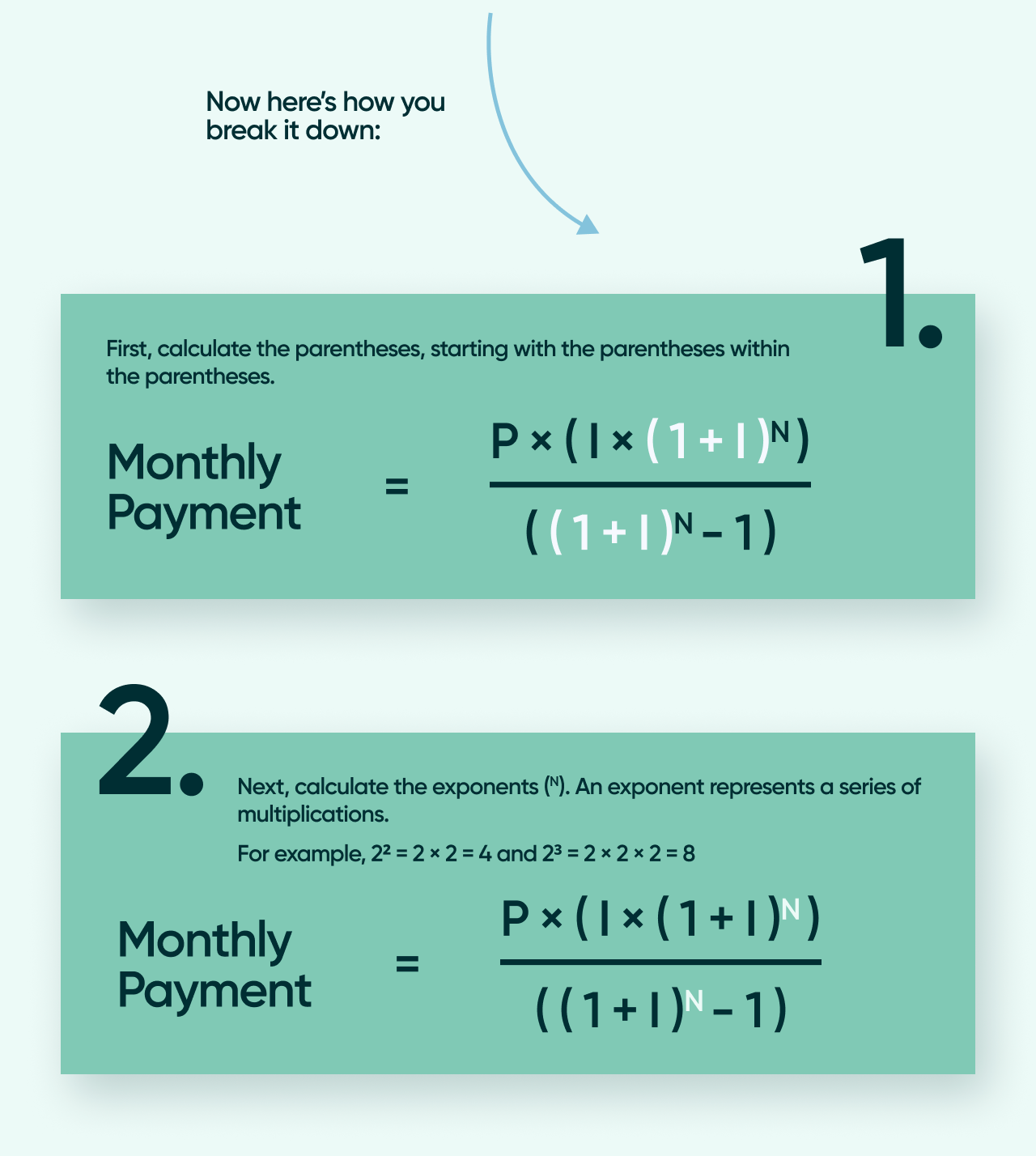

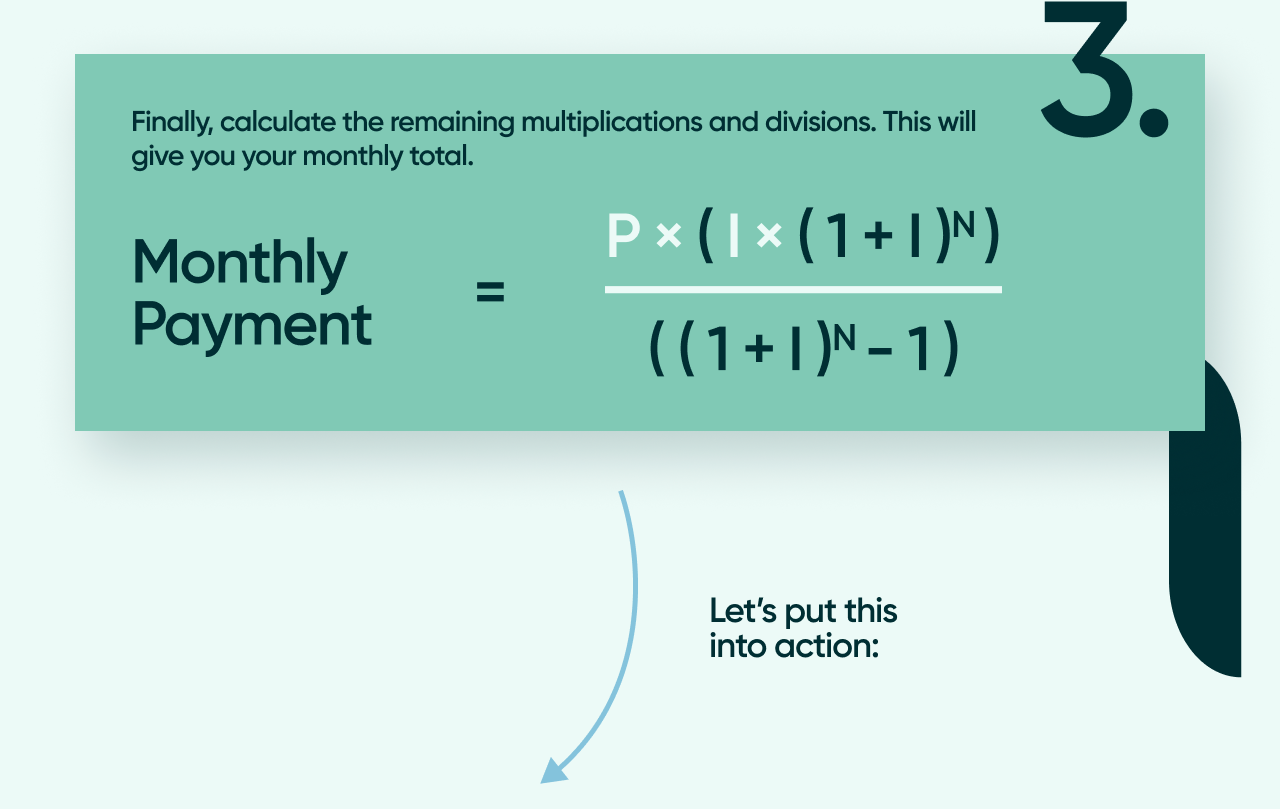

Now that you know all the terms, let’s get to the math.

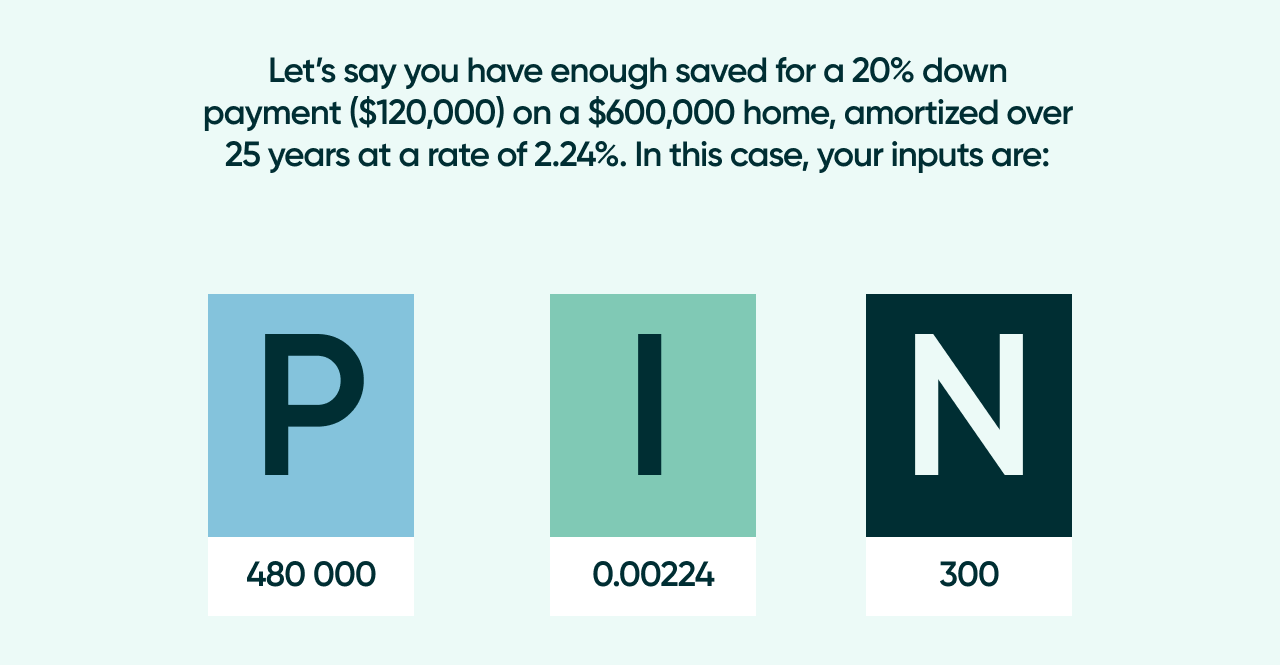

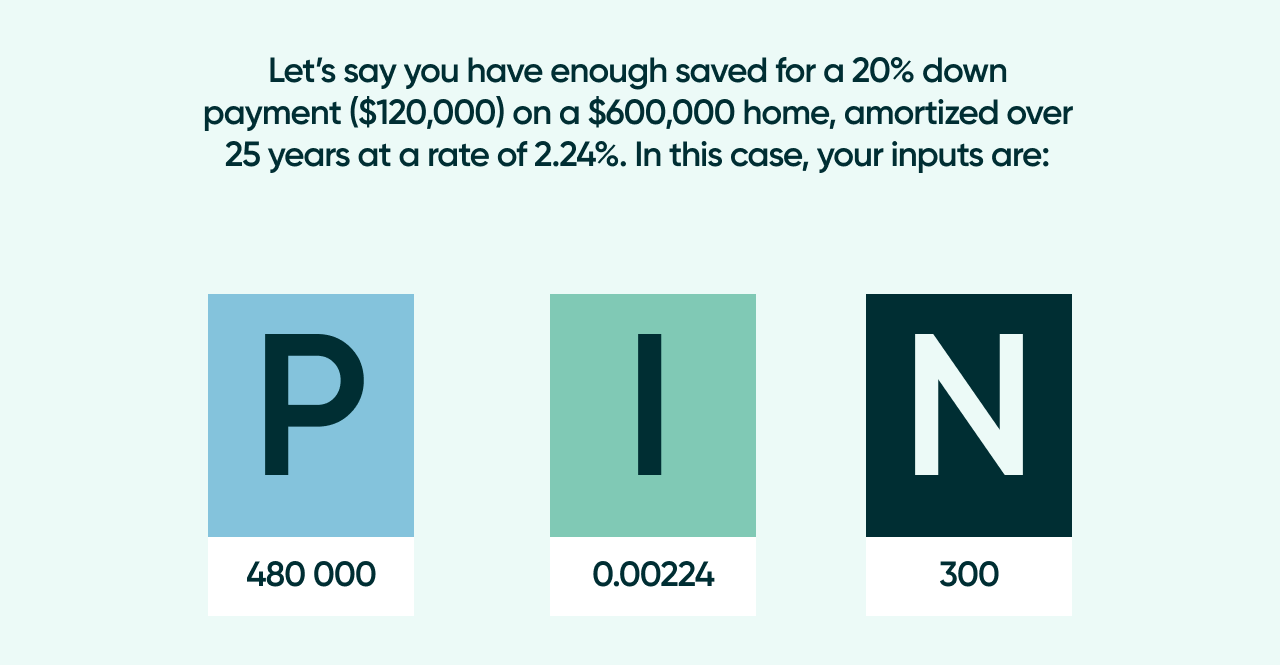

All you need is your mortgage principal, monthly interest rate, and your mortgage term (number of payment periods).

How much loan can you afford based on the mortgage math

When it comes to how much money you can borrow, most lenders use two calculations to determine the maximum amount you can afford. These can also be helpful for your own budget calculations:

- Gross Debt Service (GDS) Ratio: Your GDS includes all your housing fees such as your mortgage, utilities, housing fees, and property taxes. This amount shouldn’t exceed 32% of your pre-tax income.

- Total Debt Service (TDS) Ratio: This is when you add any additional debt payments, such as student loans and credit card debt, to your GDS. This percentage total is your TDS, and it shouldn’t exceed 40% of your pre-tax income.

While these ratios are a good estimate, it’s also important to factor in any other goals that you may have when determining how much you want to borrow.

This could include retirement savings, vacations, home renovations, or whatever you may be saving up for. If you take a bigger mortgage, you might stretch yourself thin when other expenses come up later, so set a budget you’re comfortable with and stick to it.

Are there any hidden costs I need to consider?

A mortgage isn’t the only recurring expense: homeownership comes with many other ongoing costs, which buyers need to anticipate. These include homeowners’ insurance, utilities, repairs, maintenance costs, and pest control, so be sure to do your math in advance.

Do the math and make it count

Now that you know the basics, you can better determine what a monthly mortgage may cost for homes you’re looking to purchase. The more you know, the better prepared you can be and the fewer surprises you’ll come across when you get your first mortgage payment. It’s time well invested to ensure you get the best investment for you.

Still have questions? We can help you answer all your burrowing questions and unlock the best possible rates. Talk to a specialist today.